AR Invoices (Owner Invoices)

Agave Sync allows you to export Procore Owner Invoices to Vista AR Invoices.

Owner Invoices with a status of "Approved" in Procore are synced in a posted state in Vista. We sync them in this state to allow you to immediately apply AR Cash Receipts against these AR Invoices.

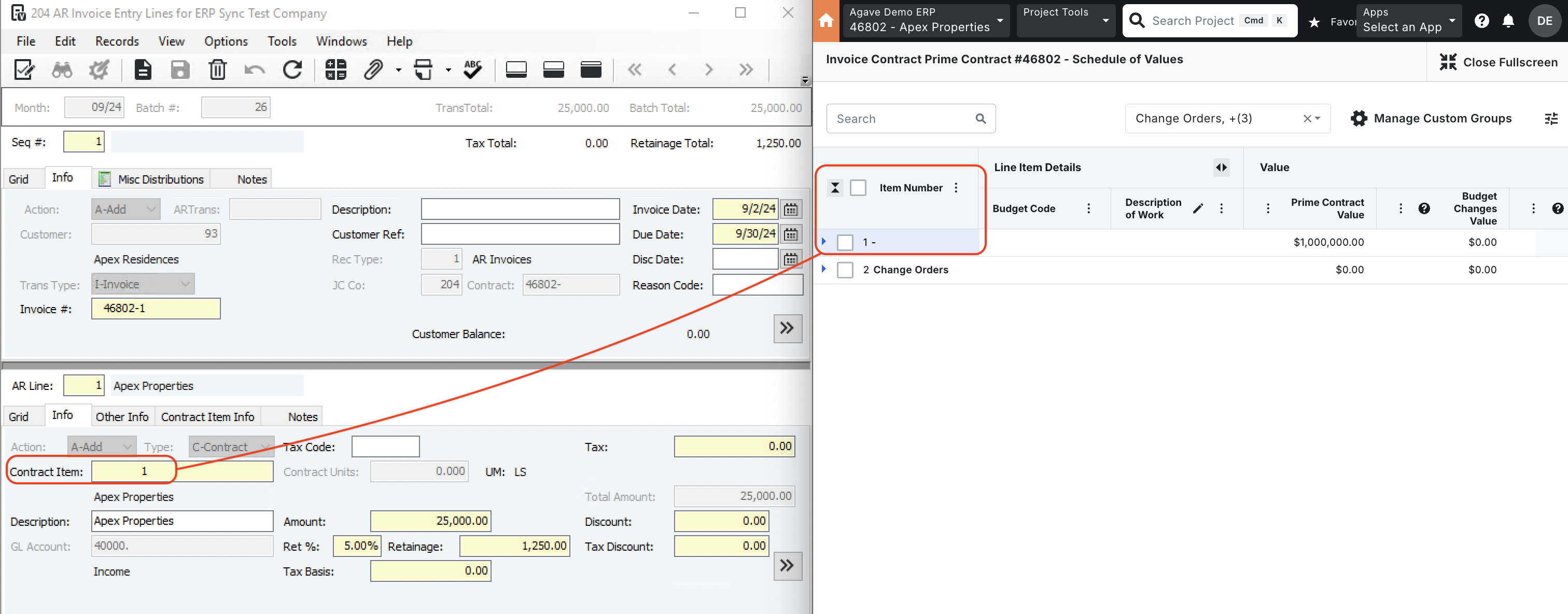

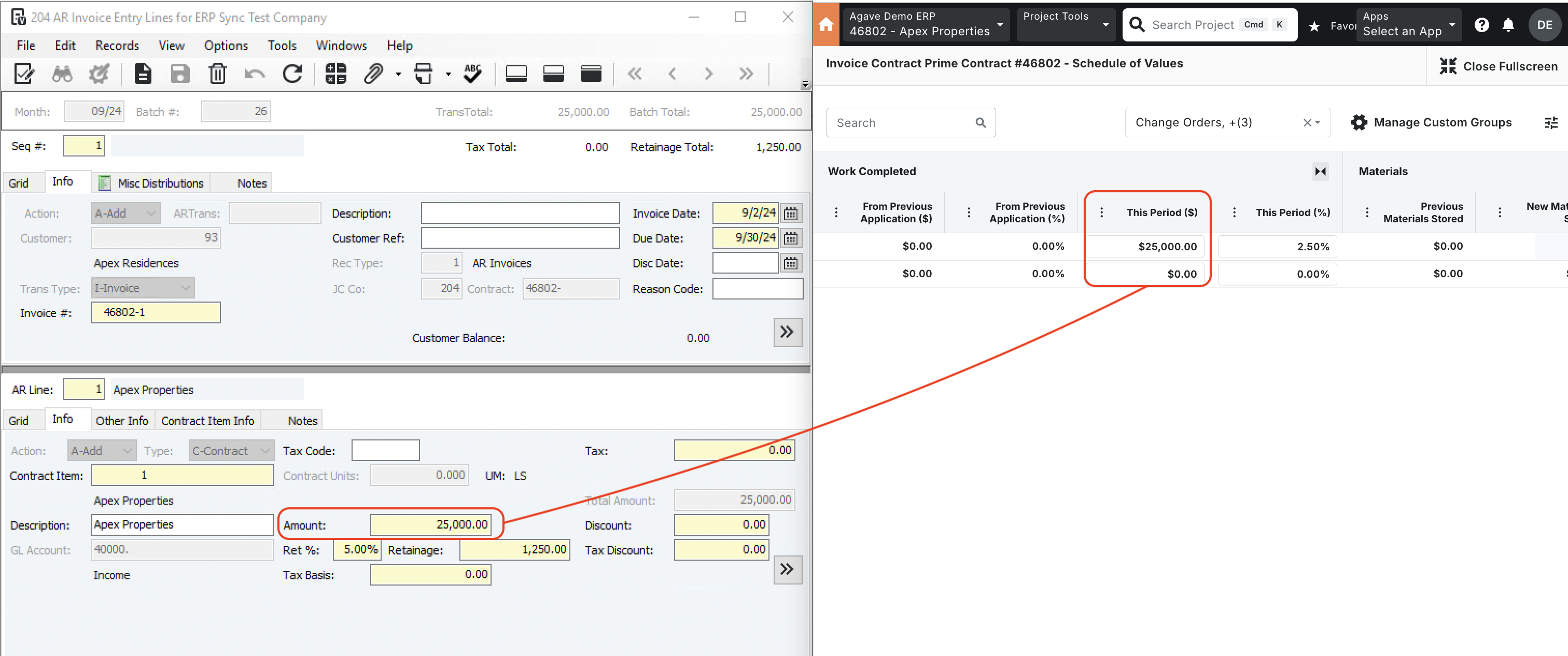

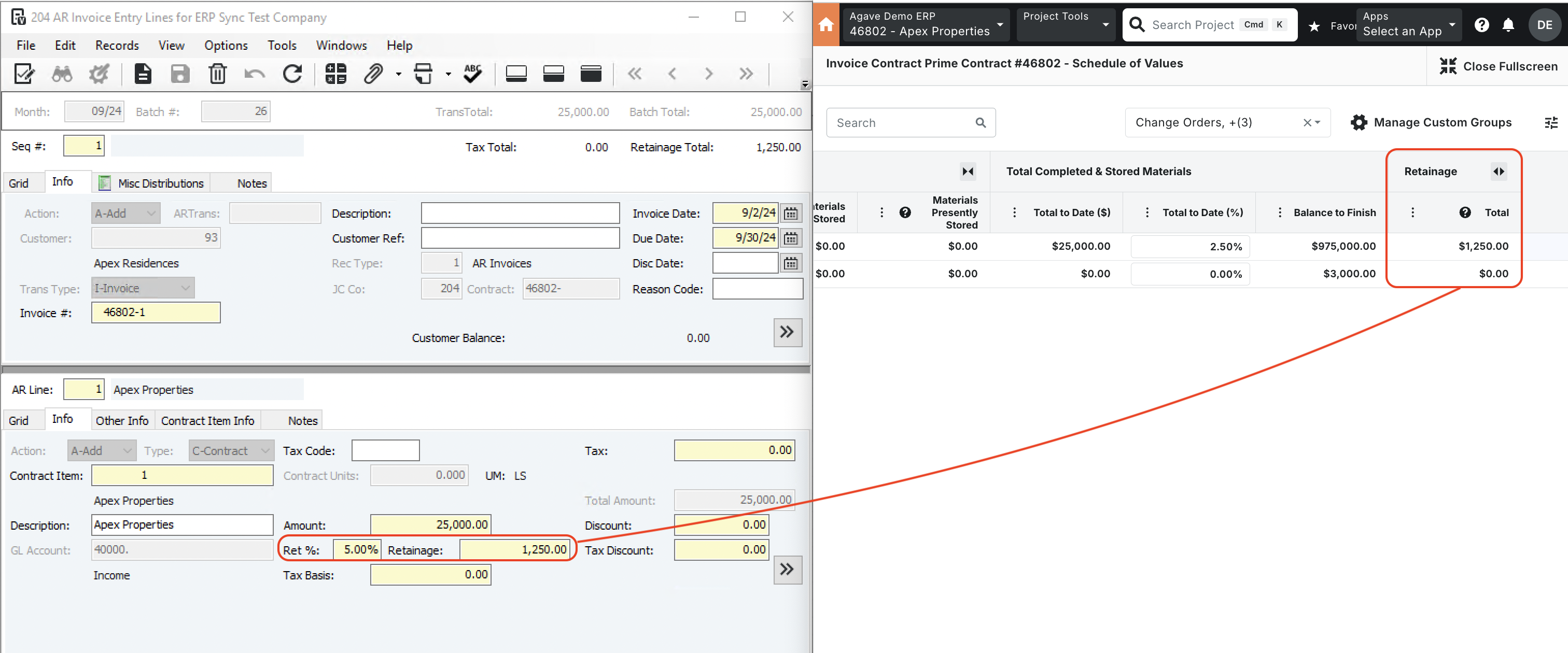

Visual Mapping

Video Tutorial

Common Errors and FAQs

Are there any pre-requisites to syncing AR Invoices?

Yes - the Prime Contract, Project, Prime Contract Change Order, and Customer referenced in the AR Invoice must be synced beforehand.

How is the Batch Month Determined When Syncing AR Invoices?

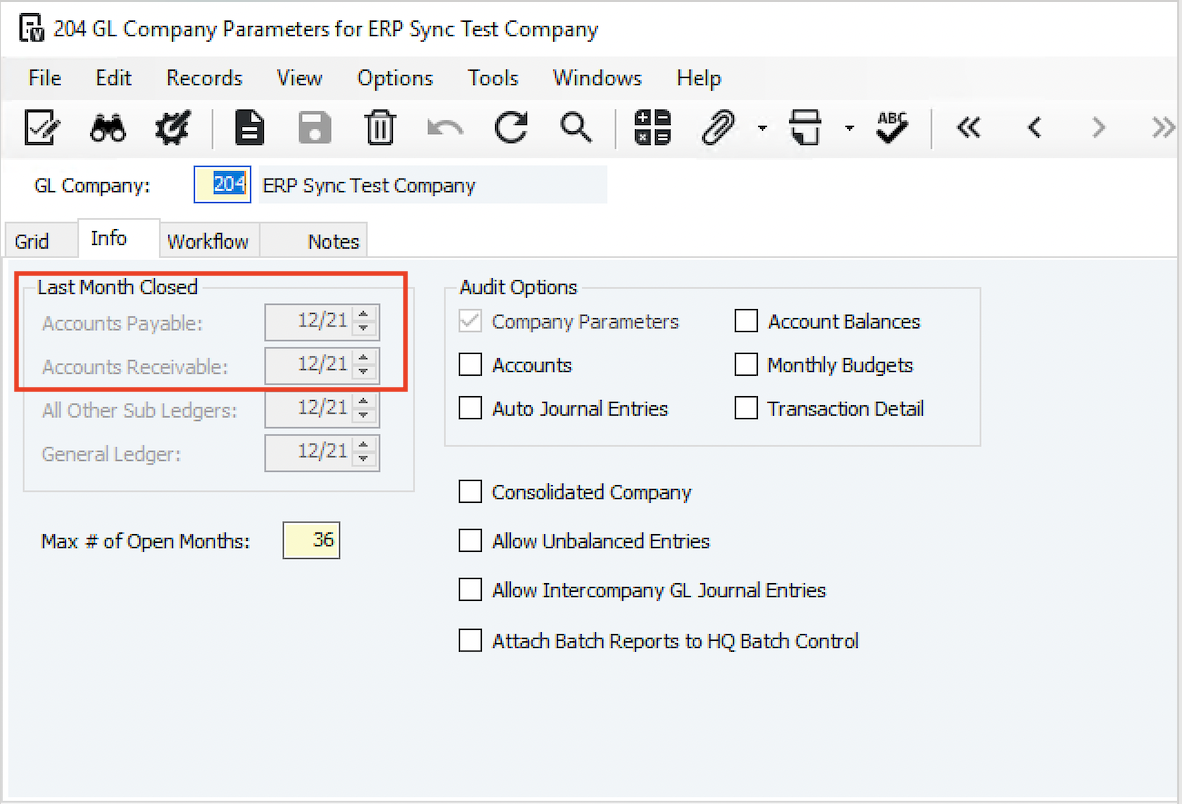

When syncing AR Invoices to Vista, we use the latest open AR Batch month. This is the month after the last closed month in GL Company Parameters.

Using the Accounts Receivable Last Month Closed from the below screenshot as an example, if an AR Invoice was synced to Vista on 2/5/2022, the Batch Month would be set as "1/22" because this is the month after the last month closed for Accounts Receivable (i.e. 12/21):

How are the subtotal and retention amounts calculated for each Line Item?

Subtotal Amount

Agave Sync calculates the subtotal for a Procore Owner Invoice Line Item using this formula:

subtotal = work_completed_this_period + materials_moved + (materials_presently_stored - materials_previously_stored on the last Owner Invoice)

This ensures the subtotal reflects only the new work and materials completed or stored during the current billing period, by subtracting any materials already reported on the previous invoice.

Retention Amount

Agave Sync calculates the retention amount for a Procore Owner Invoice Line Item as:

retention = work_completed_retainage_retained_this_period + materials_retainage_retained_moved + (materials_stored_retainage_retained_this_period - materials_preivously_stored_retainage_retained_this_period on the last Owner Invoice)

This formula accounts for new retainage amounts held during the current period, including any adjustments for materials that have moved categories (e.g., from stored to installed), while subtracting retention already reported in prior periods to avoid duplication.