AR Invoices (Regular)

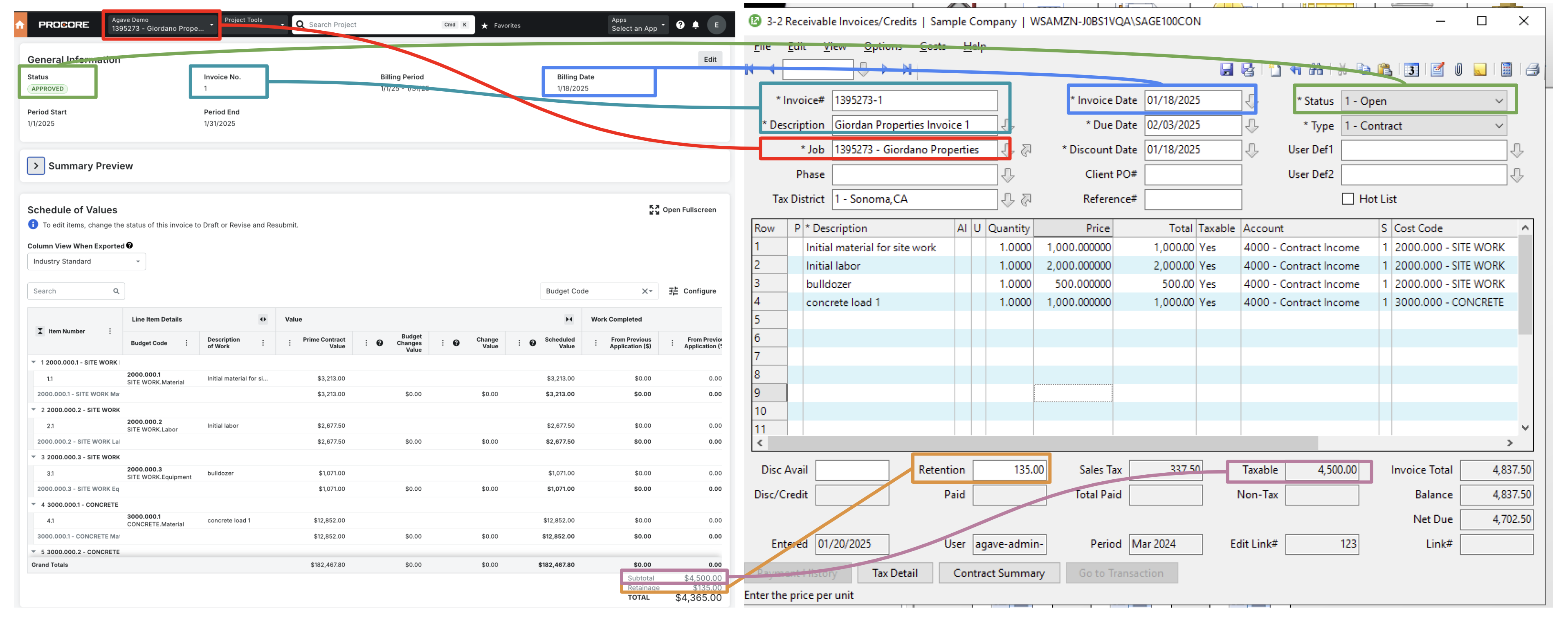

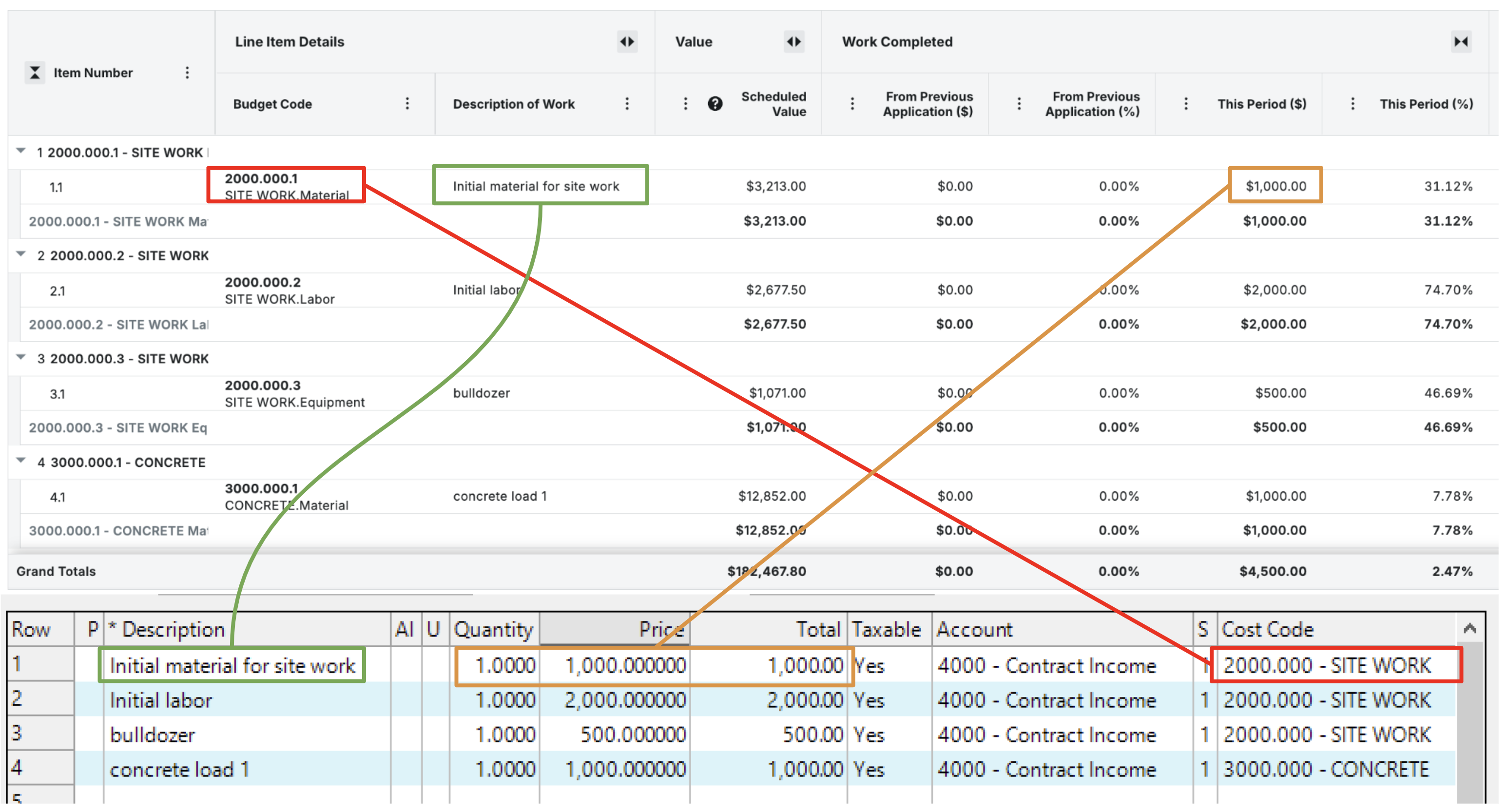

Agave syncs "Owner Invoices" in Procore to "3-2 Receivable Invoices" in Sage 100 C.

Visual Mapping

Settings

Taxes

If you use taxes on your AR Invoices, Agave can enable the following:

- The "Tax District" in Sage 100 C will be automatically populated from the Job record ("3-5 Jobs")

- All line items on the AR Invoice will be marked as taxable

Work with your Agave account rep to enable this setting.

Ledger Account

Agave can send a default Ledger Account on AR Invoices in Sage 100 C. If you use department-based subaccounts, Agave will populate the subaccount based on the Department on the Job record.

Work with your Agave rep to set up a default Ledger Account.

Dates

- Invoice Date in Sage 100 C - Syncs from the "Billing Date" in Procore. This is a required field for Agave Sync.

- Due Date in Sage 100 C - If the Billing Period in Procore has a Due Date, Agave will use this. Otherwise, the default Due Terms from the Job record in Sage 100 C are used.

- Discount Date in Sage 100 C - The default Discount Terms from the Job record in Sage 100C are used. This is required on the job in Sage 100 C.

AR Invoices (Time & Materials)

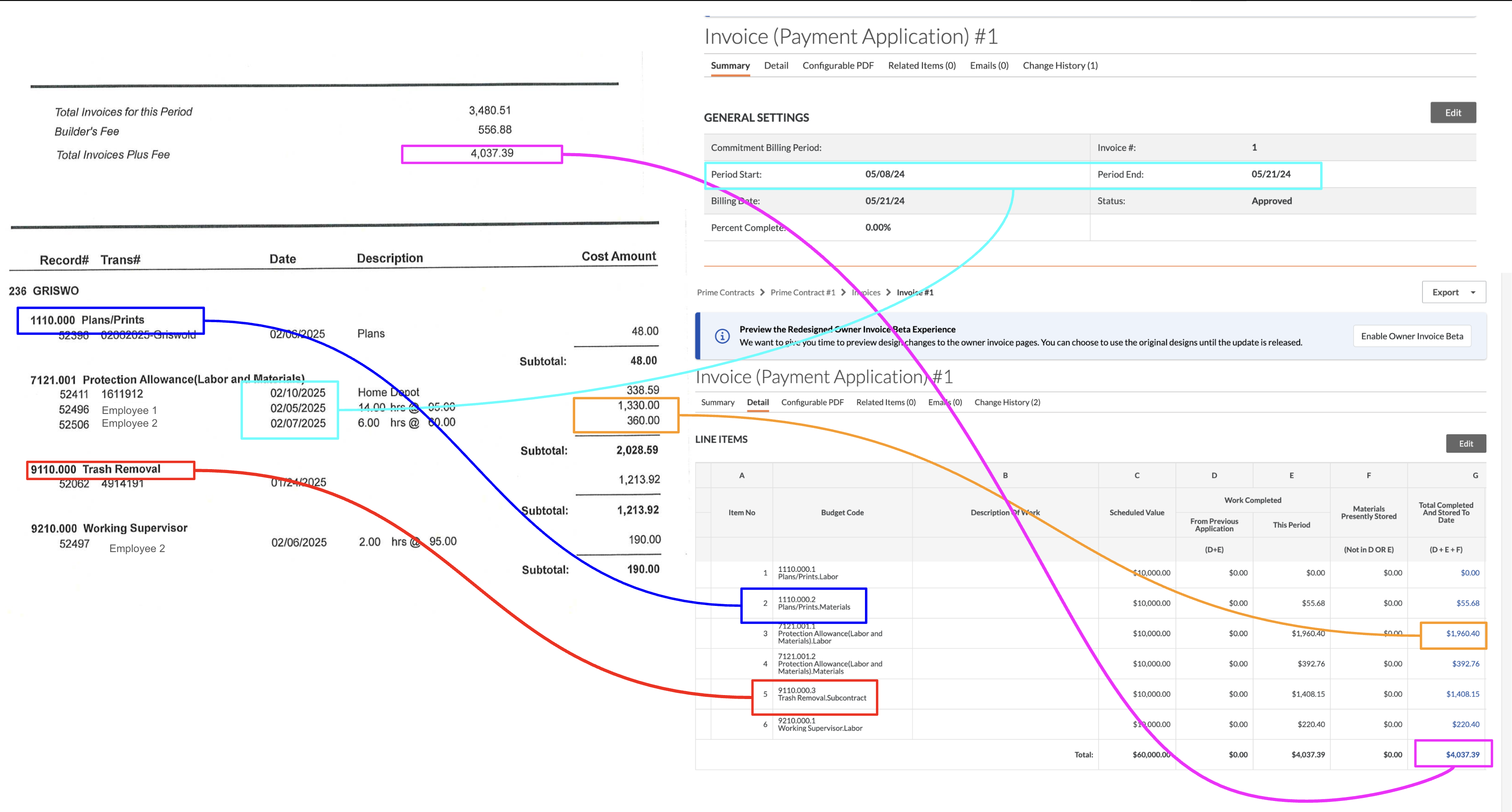

Agave also syncs Job Costs grouped by Billing Periods in Sage 100 C to Procore as AR Invoices.

Note that the pre-requisite of syncing the AR Invoices (T&M) is to make sure the Prime Contract in Procore contains all of the Budget Codes that these Job Costs in Sage 100 C is billed against.

Visual Mapping

How are the subtotal and retention amounts calculated for each Line Item?

Subtotal Amount

Agave Sync calculates the subtotal for a Procore Owner Invoice Line Item using this formula:

subtotal = work_completed_this_period + materials_moved + (materials_presently_stored - materials_previously_stored on the last Owner Invoice)

This ensures the subtotal reflects only the new work and materials completed or stored during the current billing period, by subtracting any materials already reported on the previous invoice.

Retention Amount

Agave Sync calculates the retention amount for a Procore Owner Invoice Line Item as:

retention = work_completed_retainage_retained_this_period + materials_retainage_retained_moved + (materials_stored_retainage_retained_this_period - materials_preivously_stored_retainage_retained_this_period on the last Owner Invoice)

This formula accounts for new retainage amounts held during the current period, including any adjustments for materials that have moved categories (e.g., from stored to installed), while subtracting retention already reported in prior periods to avoid duplication.