Tax Codes

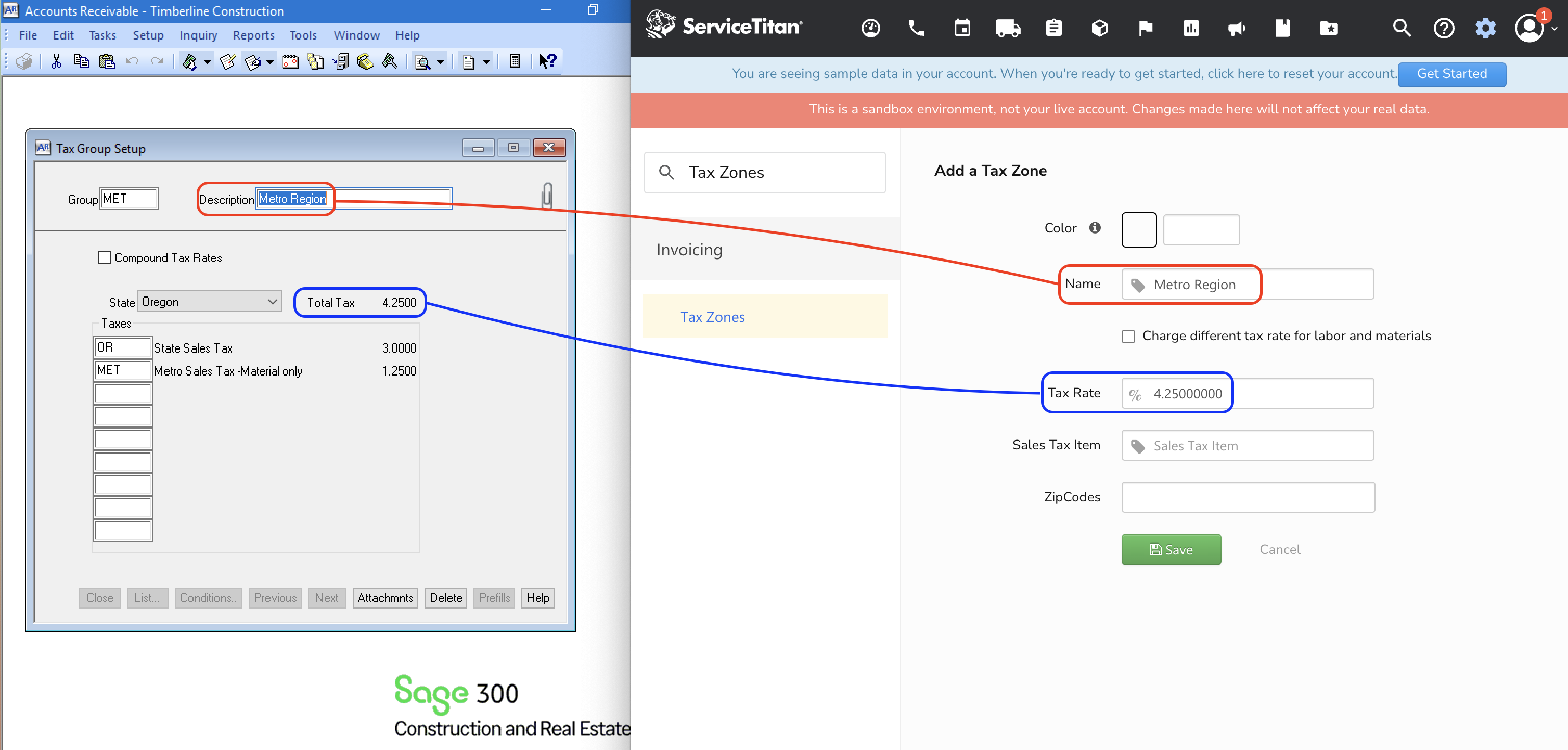

Agave Sync allows you to link Sage 300 CRE Tax Groups to ServiceTitan Tax Zones.

note

You will want to make sure the Sage 300 CRE Tax Groups and ServiceTitan Tax Zones have the same total tax rate.

Visual Mapping

Common FAQs and Error Messages

How do you enable the Master Tax File?

To enable the Master Tax File in Sage 300CRE, you will need to:

- Create a Tax Rate,

- Create a Tax Group that references the Tax Rate, and

- Set a Default Tax Group.

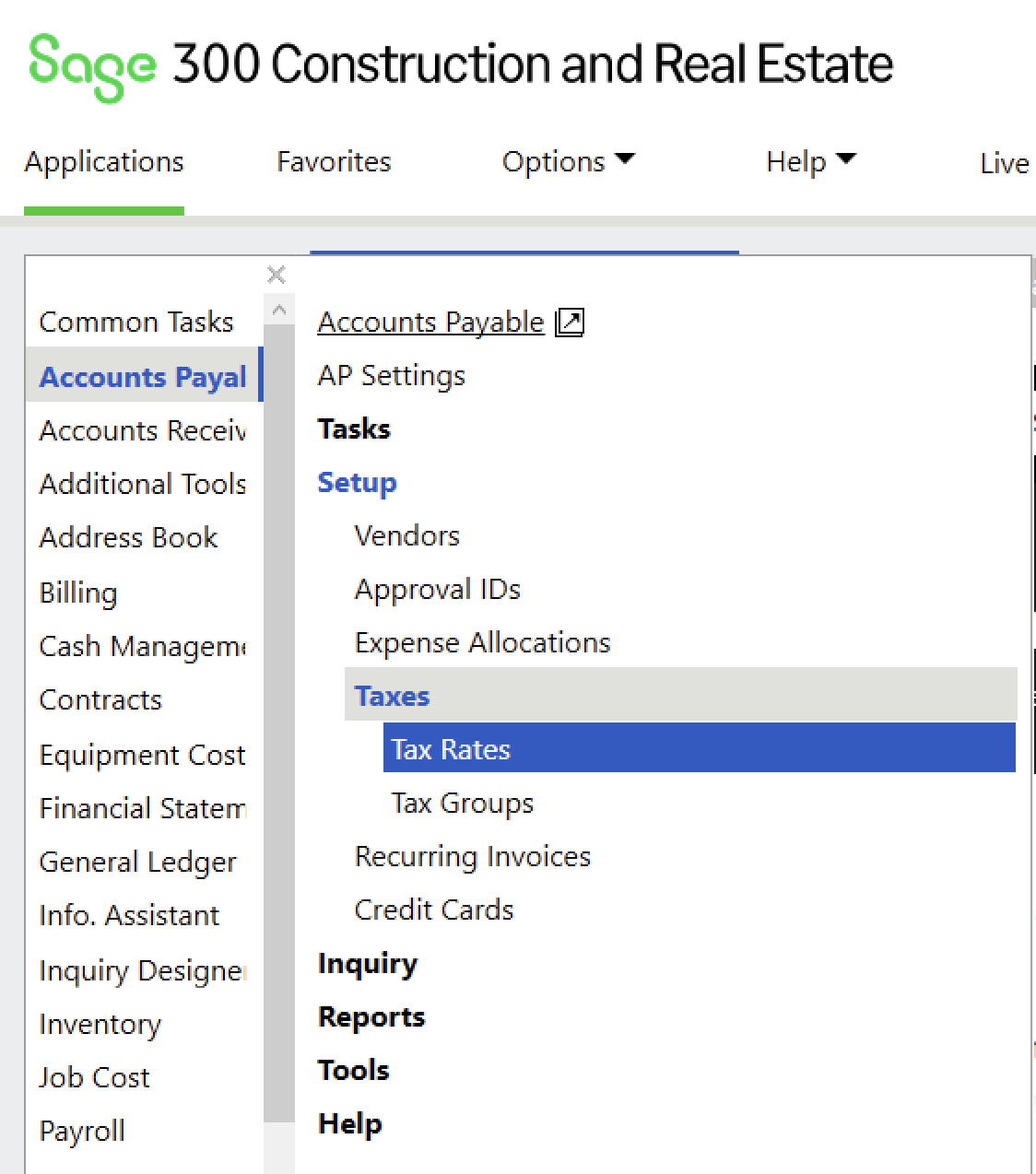

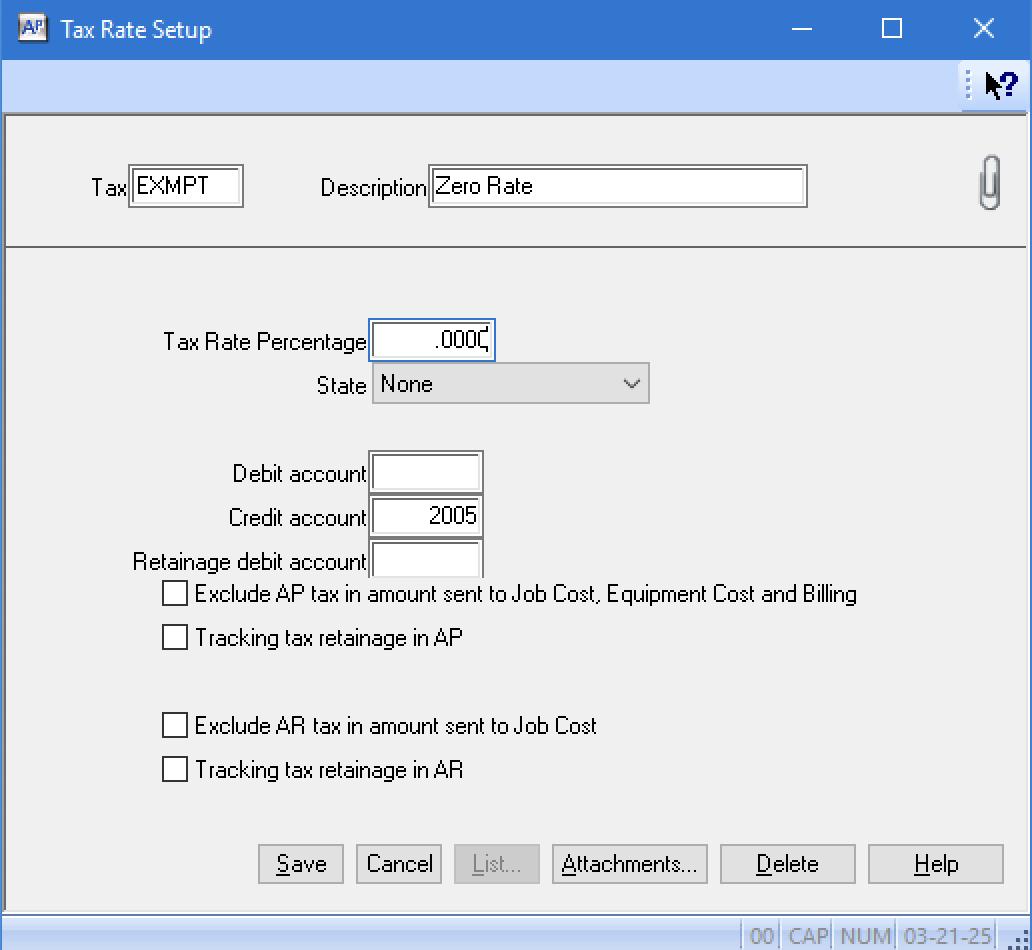

Create a Tax Rate

- From the Sage 300 CRE homepage, go to Accounts Payable --> Setup --> Taxes --> Tax Rates:

- Add details for the Tax Rate and press Save:

Create a Tax Group

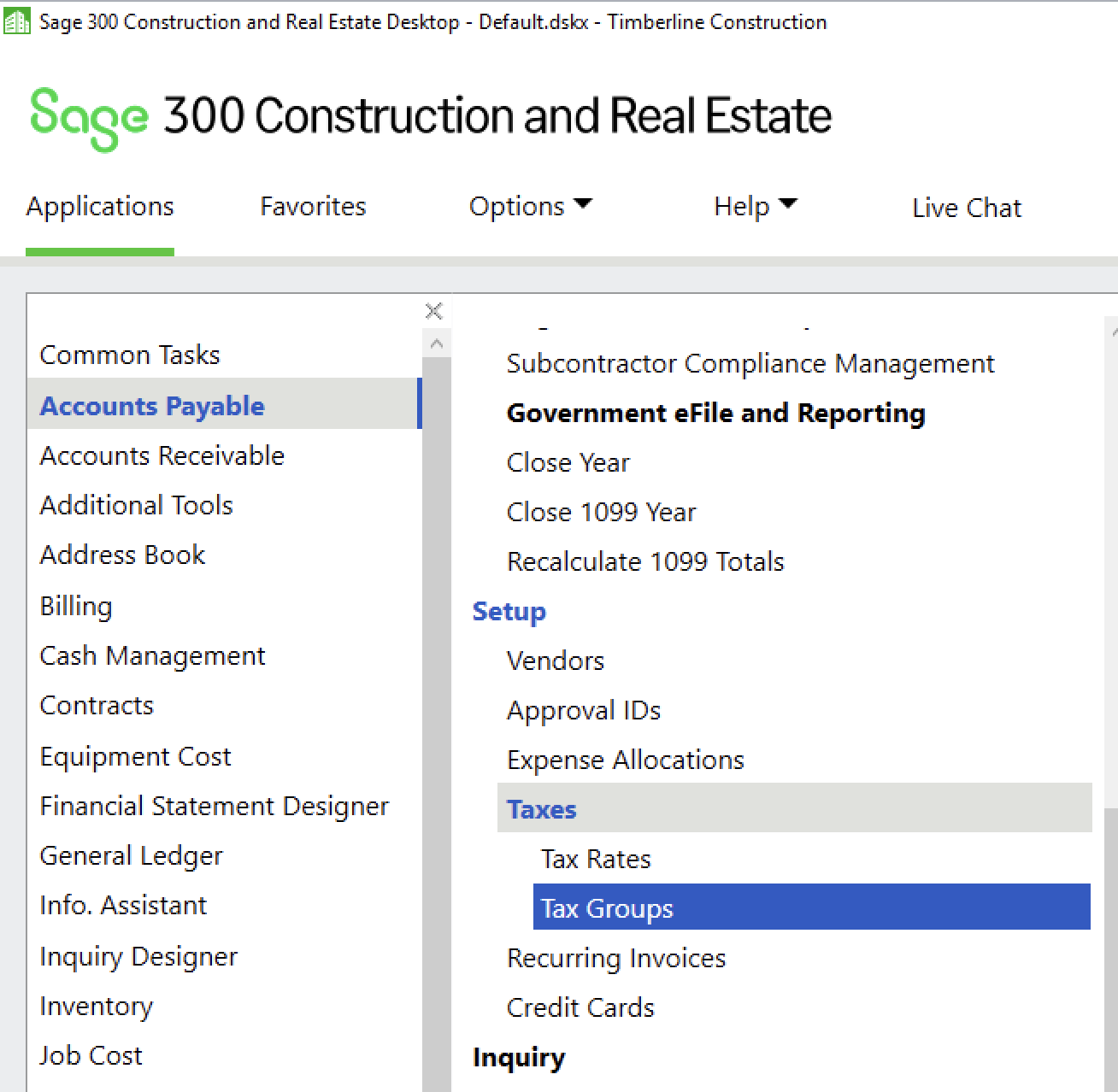

- From the Sage 300 CRE homepage, go to Accounts Payable --> Setup --> Taxes --> Tax Groups:

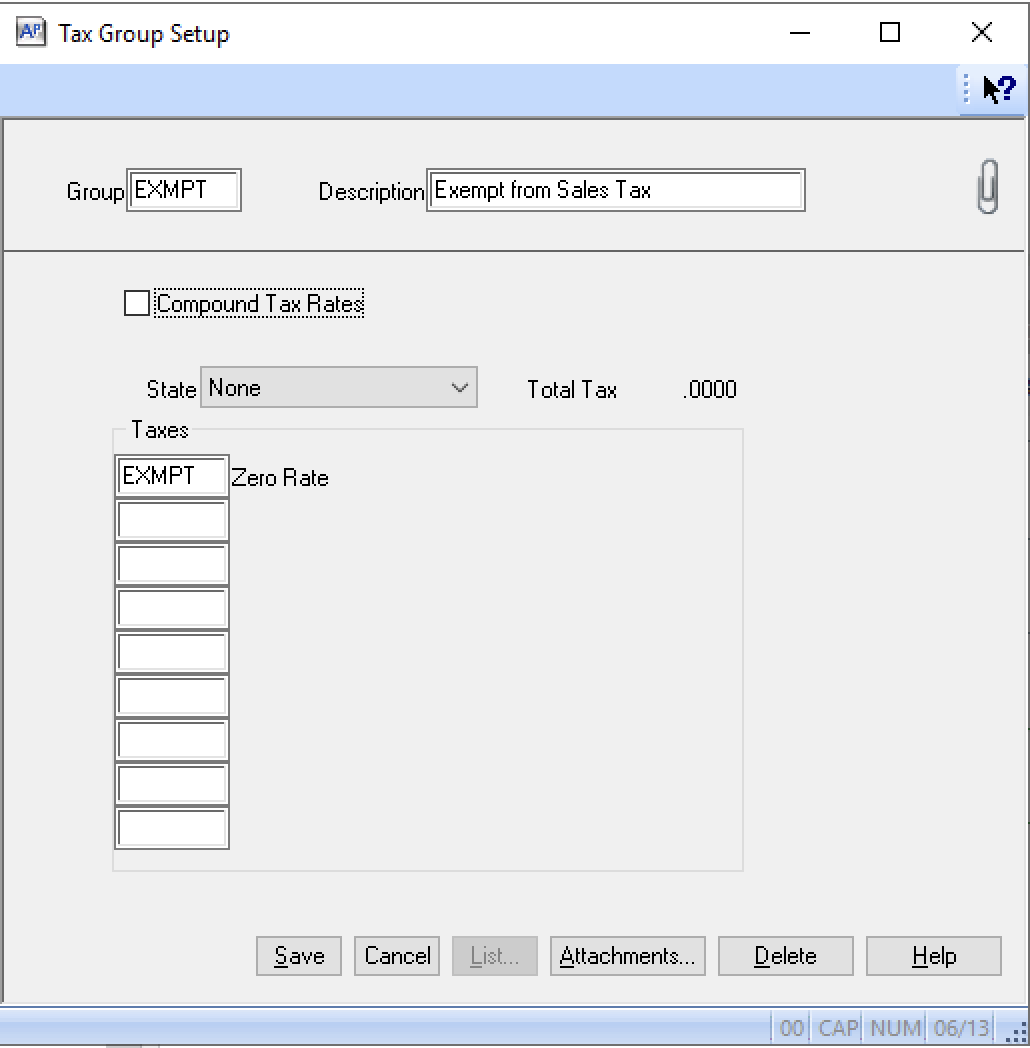

- Add details for the Tax Group and press Save:

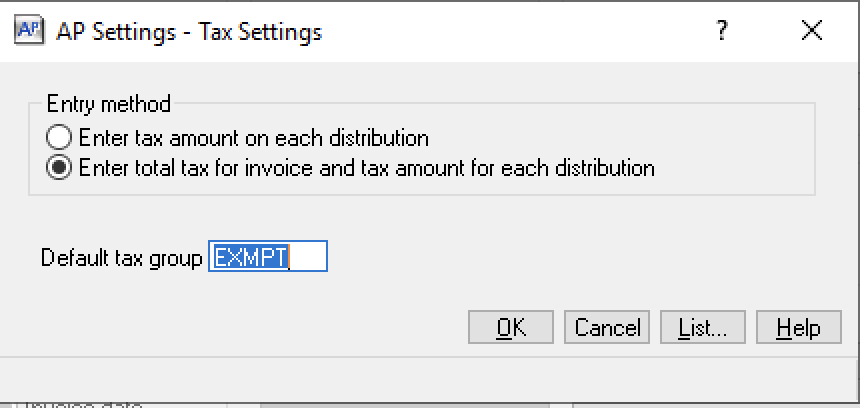

Set a Default Tax Group

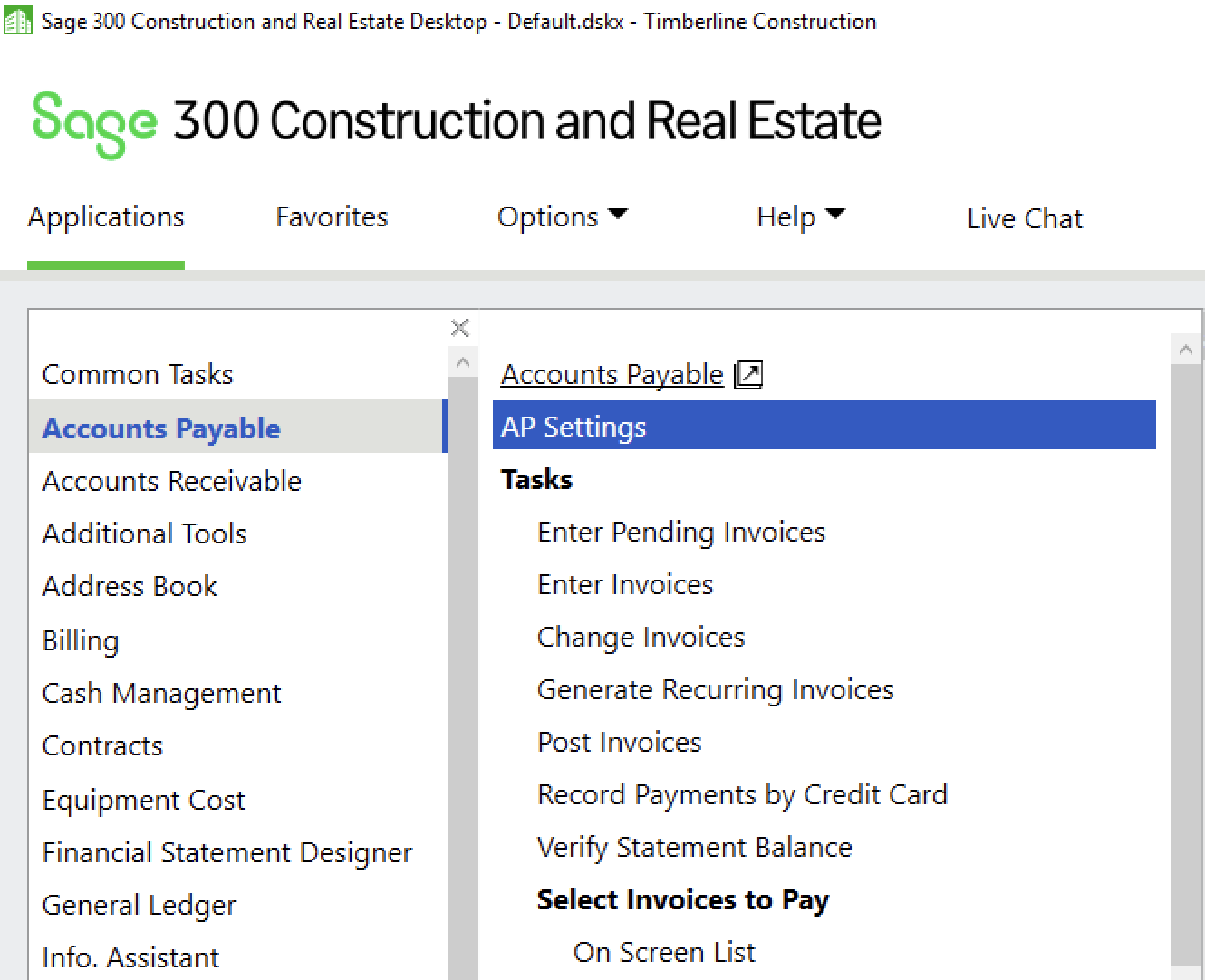

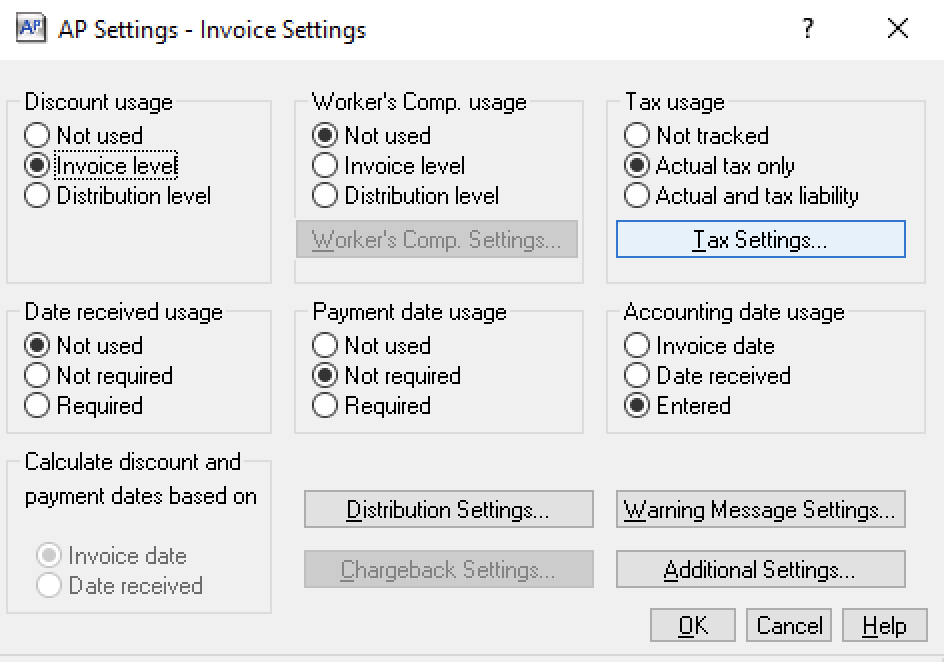

- From the Sage 300 CRE homepage, go to Accounts Payable --> AP Settings:

- Select Invoice Settings:

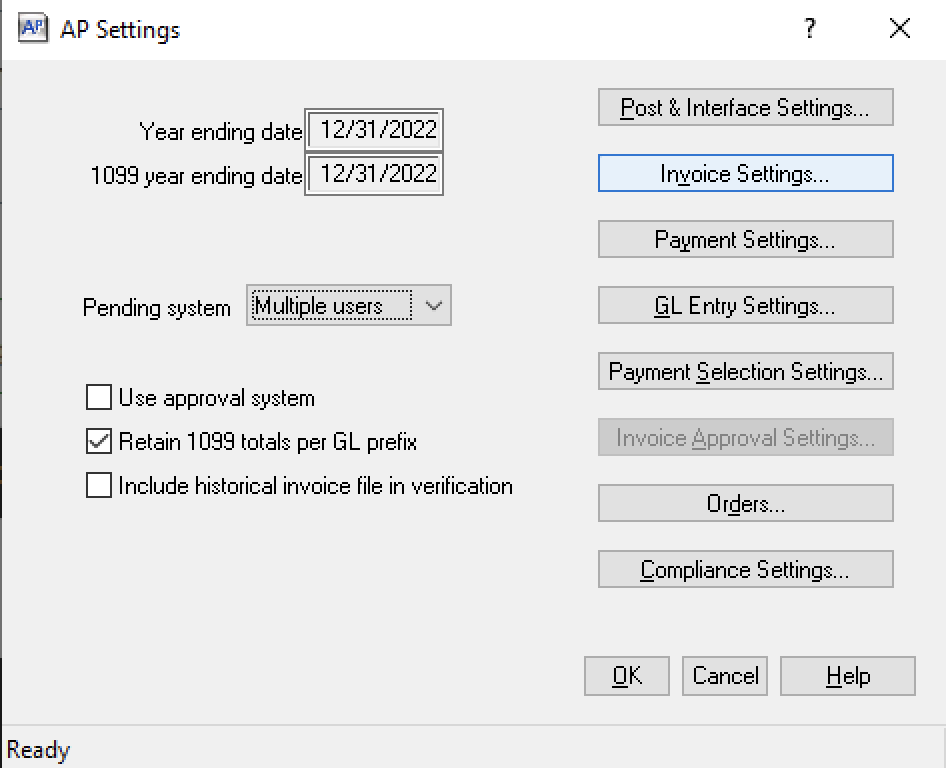

- Select Tax Usage:

- Select an Entry Method, and add a Default Tax Group by pressing List, and then OK: